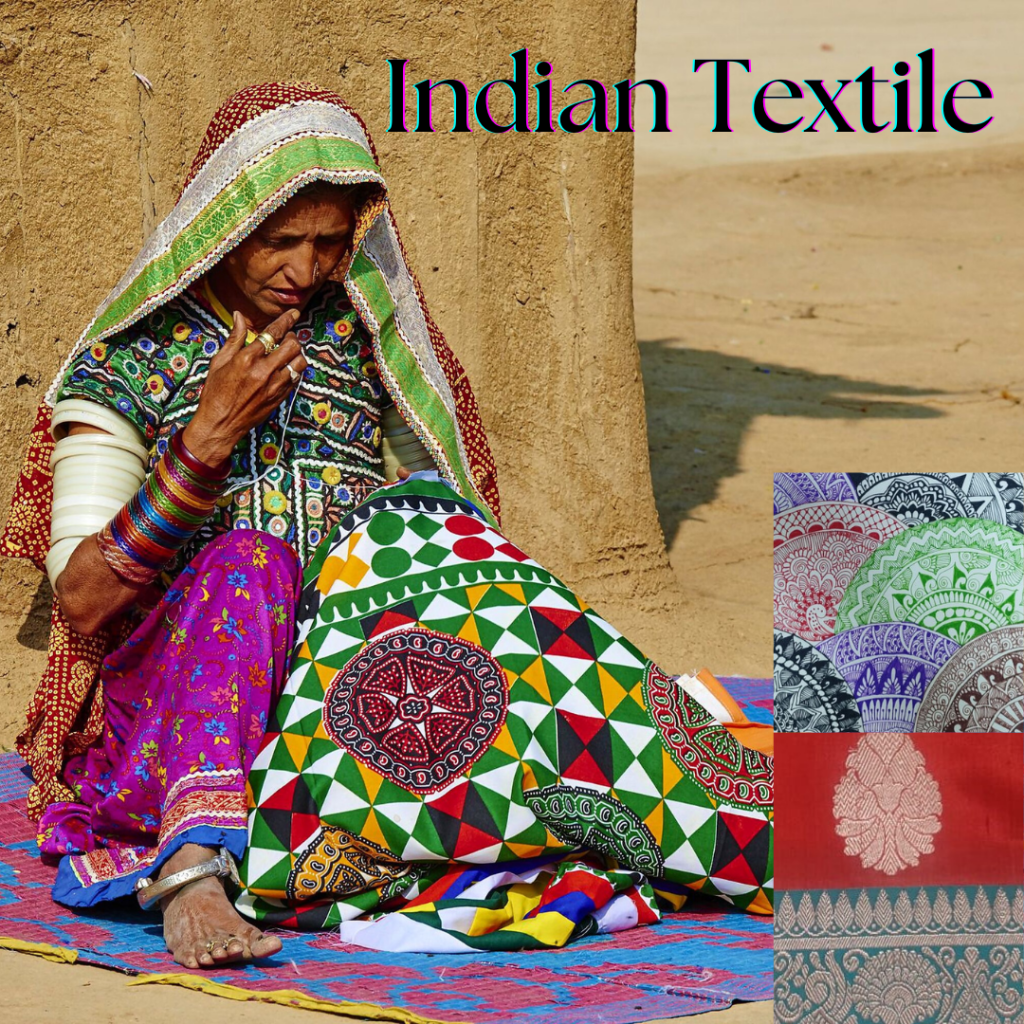

India has been famous for its rich and astonishing variety of hand-made cotton fabrics since the time of the Romans. It has also maintained several trade relationships with countries such as China, and Egypt over the ages. India still boasts of a textile industry with thousands of clusters that weave the most magnificent fabrics. But the contribution of the Indian textile industry is not significant in global terms. The major contributors to the $1420 billion global textile industry are China, Germany, Bangladesh, and Vietnam. The time has come for India to put an effort into making its position stronger in the market.

The US ban on Chinese cotton and textile import in 2022 came as a blessing for India. So far, India has not been able to capture the global textile industry because its textile production depended more on cotton (Gupta, 2022). In contrast, other countries used synthetic materials for textile production, which led them to increase their contribution. The ban on China’s cotton and apparel exports opened the door for India to cater to the market need and grab the opportunity of becoming a major player in the global textile industry. Cashing upon this opportunity will increase India’s exports from $44.4-$65 billion and create 7.5-10 million jobs (Gupta, 2022).

Like India, other potential countries can also be tempted to avail the golden opportunity. Bangladesh, Pakistan, and Vietnam come up as top contenders. For example, Bangladesh has a competitive advantage over India and other countries in terms of cheap and skilled labour, power availability at affordable rates, supportive government policies, least-developed country status, free trade agreements, and technological advancement in the textile industry (5). However, India can still lead by exploiting its easy accessibility to available funds with fewer non-performing loans in this industry (The Economic Times, 2021). This is a big advantage over countries like Bangladesh, which may incur higher business costs due to a rapid increase in borrowing rates (Indian-apparel, 2016).Like India, other potential countries can also be tempted to avail the golden opportunity. Bangladesh, Pakistan, and Vietnam come up as top contenders. For example, Bangladesh has a competitive advantage over India and other countries in terms of cheap and skilled labour, power availability at affordable rates, supportive government policies, least-developed country status, free trade agreements, and technological advancement in the textile industry (5). However, India can still lead by exploiting its easy accessibility to available funds with fewer non-performing loans in this industry (The Economic Times, 2021). This is a big advantage over countries like Bangladesh, which may incur higher business costs due to a rapid increase in borrowing rates (Indian-apparel, 2016).

India also holds a unique position as a self-reliant industry- from producing raw materials to finished goods as well as emerging as the world’s largest cotton producer. India exported $44.4 billion of textiles and apparel (including handicrafts) and readymade garments worth $6.19 billion in FY22 alone. It is projected that India will produce 7.2 million tonnes of cotton (or around 43 million bales of 170 kg each) by 2030. Indian textile industry also enjoys government policy support such as 100 percent FDI by the automatic route, Production-linked Incentive (PLI) Scheme worth ₹10,683 crores (US$ 1.44 billion, investment schemes such as Integrated Textile Parks (SITP) (US$ 184.98 million) and Technology Upgradation Fund Scheme (US$ 961.11 million) (IBEF, 2022).

However, the Indian textile industry needs to work on the factors which put the industry in back gear. Some of these factors are the number of shipping days (63 days) for export delivery, high energy consumption cost, minimal free trade agreements with key importers such as the EU, the US, and the UAE, and export tax rate. However, initiatives such as the implementation of a national logistics policy and renewable energy policy and negotiation of free trade agreements (FTAs) with the countries that are its primary export destinations (Gupta, 2022), are steps in the right direction. If India continues to undertake the required measures to improve, it will undoubtedly assume a favourable position in the global textile industry in the years to come.

References:

- Gupta, A. (2022, August 9). Weaving a strategy for an impressive future. Business India. https://businessindia.co/magazine/weaving-a-strategy-for-an-impressive-future

- Online, (2021, June, 8) SIDBI: Textiles and Apparels Industry availed credit of Rs 1.62 lakh crore: SIDBI-CRIF. The Economic Times. https://economictimes.indiatimes.com/small-biz/sme-sector/textiles-and-apparels-industry-availed-credit-of-rs-1-62-lakh-crore-sidbi-crif/articleshow/83333073.cms?from=mdr

- Talk, A. (2016, April 12). Textile Mills In Bangladesh Seek More Credit Support. Apparel News, Textile News, Latest Events, Exhibitions, B2B Directory – indian-apparel.com. https://www.indian-apparel.com/textile-mills-bangladesh-seek-credit-support/

- Textile Industry in India, Leading Yarn Manufacturers in India. IBEF. (n.d.). India Brand Equity Foundation. Retrieved October 28, 2022, from https://www.ibef.org/industry/textiles

- What Makes Bangladesh — A Hub Of Garment Manufacturing? (2018, July 18). Medium. https://medium.com/@stitchdiary/what-makes-bangladesh-a-hub-of-garment-manufacturing-ce83aa37edfc

Author: Shweta Dwivedi

About the Author: Student of PHD 01

#iimbodhgaya #theenlighteningiim #textileindustry #traderelationships #global #handmade #indiantextile